Stop speaking of the three pillars or triple bottom line of sustainability

A guest post by Ron McCormick

The following post is one of a series previewing the research that will be presented at the in Sacramento, California (4–8 November 2018).

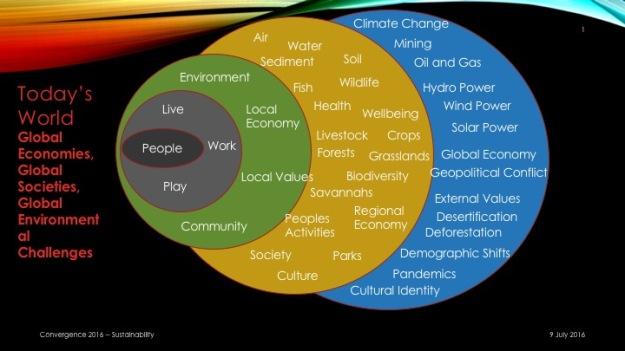

The original dream of three separate but equal pillars of sustainability has become a fallacy; the triple bottom line is dead. The essence of sustainability in practice is to act with increased resilience in mind, and in all aspects of living, working, and playing in a social-ecological landscape. The thrust of the Sacramento meeting is to seek a realignment between economic development and ecological and societal stewardship. Our session, to be held Tuesday afternoon, will present practical and theoretical aspects of corporate and community approaches to sustainability and resilience. I encourage you to available on the meeting website. For this blog I’d like to speak more to the topic of the ending segment of our session, a debate titled “The sustainability triple bottom line is dead—should we take it off the respirator?” We won’t actually be debating the topic in depth, as it is much too late to rehabilitate the idea. Instead, we will  host an Irish wake for the triple bottom line (TBL), and toast an old friend whose time has come and gone. Why we feel this way will take some explanatory background on economics, ecology, societal equity, and systems approaches.

host an Irish wake for the triple bottom line (TBL), and toast an old friend whose time has come and gone. Why we feel this way will take some explanatory background on economics, ecology, societal equity, and systems approaches.

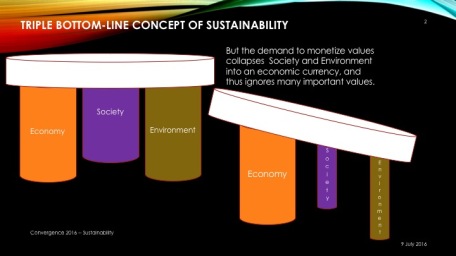

Those three pillars—economy, ecology, society—formed the “triple bottom line” of sustainability assessments in the mid 1990’s. Many variations on how to name the three pillars exist: equity, ecology, economy; people, planet, profit; community, earth, employees; and others. Over the years, it became clear to sustainability practitioners that ecology and equity were treated as lesser pillars, and most decisions devolved to benefits and costs that had real dollar values assigned, regardless of the intrinsic ecological or social value of some resources. It is not easy to account in dollars the gain or loss of social equity, and many ecological resources defy monetization, despite the LCA movement’s attempts. Thus, TBL was effectively reduced to the old corporate mantra of “show me the [single] bottom line” of profit or loss.

The staying power of using just the one pillar (profit) lies in how boundaries are drawn. If you operate a factory, you know how much it costs for stuff—materials, water, energy—to flow into the factory. And, you know what it costs to send what remains—wastes, finished products, marketable post-production materials—out into the world. What accumulates within the factory’s boundaries—cash, machines, buildings—is profit, simple as that.

The staying power of using just the one pillar (profit) lies in how boundaries are drawn. If you operate a factory, you know how much it costs for stuff—materials, water, energy—to flow into the factory. And, you know what it costs to send what remains—wastes, finished products, marketable post-production materials—out into the world. What accumulates within the factory’s boundaries—cash, machines, buildings—is profit, simple as that.

Actually, it’s only as simple as that if you discount ecology and equity. Those material, water, and energy inputs come from somewhere else, and eventually all that goes somewhere else, mostly in a less useful, degraded, non-usable, or toxic form. As a business, should you be responsible for all that goes on outside your boundaries? To compete in a market, local or global, capitalism pressures you to minimize costs, regardless of equity or ecological issues. To satisfy investors, you need to maximize profits, again, regardless of other concerns. The economic bottom line incentivizes you to source the lowest cost inputs and spend as little as possible on your waste stream to stay economically viable, equity and ecology be damned! But, plants and animals optimize efficiently; they do not seek universal maximization, and they don’t borrow and hope the future will pay off the deficit, as do some human economists.

As currently practiced, “free market” economics is designed to create more capital and growth (the economic pillar), but not more capitalists (the equity pillar) or more resource conservation (the ecological pillar). Using capital to acquire more capital is rewarded (“Greed…is good.” -Gordon Gekko, in the 1987 film Wall Street), but an overemphasis on short-term efficiency reduces resilience and opens a system to disruption by unexpected feedbacks from slower, longer-acting economic, social, and ecological constraints. Actions taken to build social equity with workers, clients, and customers, think long-term and forgo meeting arbitrary quarterly profit statements, and minimize waste in the entire process chain are usually given the stick. Wealth is captured inside the corpus, and that is how the market values the company. Stock valuation does not extend to what is created for the greater society (via economic processes, ecosystem flows), their customers, and their workers.

We think of ecologists observing the flow of water, air, or chemicals from one place to another by day, month, or year. And we think of economists observing the rate at which dollars flow between pots of money (stocks). Since humans do one thing and plants and animals do the other, surely the analyses are totally different, right? At this point, economists would start to dazzle you with quantitative models of how the little pieces of green paper (or today, digital ledger entries) move about in a predictable and orderly fashion to create stuff. And the ecologists would overwhelmingly bore you with huge box and arrow diagrams showing how polar bears come from sunlight. But, when viewed in the light of systems ecology—more accurately, the ecology of complex systems—both scenarios can be described in the same terms and using equivalent types and scales.

The goal of sustainability is a canard, as is the TBL. Social-ecological resilience is the only viable path. We keep thinking that changing monetary policy will offer a way out. We need to abstract one level back to social memory, as this is what drives or guides or steers where the bits of green paper go. Standard TBLs on neo-classical economics don’t have the flexibility to adapt to the change in scale at a rate sufficient to meet social and ecological resilience requirements. Social equity and ecology operate at both faster and slower rates of change—we view any delay in “return on investment” as “losing money”—but, preaching “recession to avoid total collapse” is not an easy conversation to have, either. To get beyond TBL to systems thinking about resilience requires a breaking of that social-ecological meme. But, getting systems ideas into the zeitgeist of most current social systems will require time and several new memes.

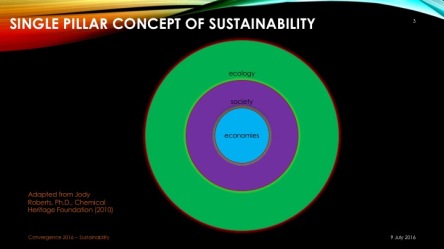

Which brings us back to celebrating the end of the TBL with a fine Irish wake at the end of the session. Economy resides wholly within a society, which is completely embedded within their ecological setting. This is the single pillar concept of sustainability, and those relationships only hold if all three elements within the pillar are resilient in their processes. As discussed in the original and subsequent works from members of the , the TBL concept brought the idea of integrating ecology and equity within the economics of human societies. However, as practiced, economics still rules over the other two elements, leading to clear failures of integrations despite the desire expressed in plans and assessments. We will be presenting several frameworks and examples of how to move beyond TBL. We hope to lead you in to a deep, primal commitment to substantive systems approaches in planning for and implementing management actions. Using complex systems approaches offer the clearest path to achieving those future conditions that a society desires and that their supporting ecological landscape can provide.

Our session in Sacramento will ask you to consider several new memes and frameworks, and also to step away from (with no regrets) and firmly reject greenwashing, surface sustainability, and partial descriptions of a false TBL.

Session information: A Dialogue and Debate on Science, Sustainability, and the Science of Sustainability

Tuesday, 6 November 2018 | 1:00 PM–4:15PM | Hall D

Additional reading materials:

Campellone RM, Chouinard KM, Fisichelli NA, Gallo JA, Lujan JR, McCormick RJ, Miewald TA, Murry BA, Pierce DJ, Shively DR. 2018. The iCASS Platform: Nine principles for [social-ecological] landscape conservation design. Landscape and Urban Planning. Vol 176, August. ().

Kapustka L, McCormick R. 2015. The Rationale for Moving Beyond Monetization in Valuing Ecosystem Services. Integr Environ Assess Manage. .

McCormick, R J, Pittman J, Allen TFH. 2010. Chapter 16: The Ecology of Economics from a Complex Systems Perspective. In: Environmental Risk Assessment and Management from a Landscape Perspective, Kapustka L and Landis W (Eds.). John Wiley & Sons, Hoboken, NJ.